Smart, Simple, and Stress-Free Tax Filing Starts Here.

We make tax season easier... with expert guidance, secure filing, and personalized support you can count on.

Don’t Roll the Dice With Your Tax Season.

This isn’t a game of chance. When it comes to your finances, experience matters.

Let a tax professional handle your return with precision and care.

Expert Strategy, Not Guesswork

Our team doesn’t “hope” for good results ... we plan for them. Every deduction, every credit, every move is intentional so you can keep more of your money where it belongs.

Secure, Smart, Seamless

Your financial info is safe, your process is simple, and your results are powerful. 100% encrypted, digital, and backed by real humans who care.

Educating You for Financial Success

Whether you get a refund or owe, we make sure you understand why. Our mission is to help you make smarter money moves year after year — not just survive tax season, but thrive beyond it.

Meet Your Tax Preparer

Jeffery Head

Tax Pro | Tech Innovator | Educator

My journey into the tax industry started unexpectedly. What began as simply helping my best friend with her business quickly turned into a passion. As I gained more knowledge and experience, I realized I wanted to go deeper—not just preparing taxes, but truly understanding the process so I could educate others and change lives.

I am an easy-going, approachable person who believes in staying teachable. I love learning, and I love helping people learn. Clients describe me as friendly, patient, and welcoming someone who listens first and always puts their needs at the center of the process.

My approach is simple: honesty, clarity, and client-first service. I don’t just tell you what’s happening with your taxes I show you, so you feel empowered and informed. When the opportunity came to start selling tax software, I was excited because I knew how user-friendly it was compared to what I’ve used in the past. My immediate response was, “When can I start?”

Expanding into software sales and building a team felt natural to me. I believe in giving others the same opportunities that were given to me. Leadership, for me, is about creating more bosses, not followers.

I live by the SMART goal method, and I encourage every client and every team member to stay organized, put in the work, and remain open to learning. It’s how I operate, and it’s why clients trust me. They know the process with me will be simple, professional, and honest.

Outside of business, I’m grounded by nature, karaoke nights, good food, and spending time with my family and other likeminded individuals.

Looking ahead, my goal is to build leaders, grow TruePath Tax & Tech nationally, and continue stepping into my calling as a coach who helps others become their best.

Tax Help Corner

Tax Payer Bill of Rights

Learn your rights as a taxpayer, including the right to privacy, representation, and clear communication.

Earned Income Credit (EIC)

Find out if you qualify for the Earned Income Credit and how it can increase your refund.

Where’s My Refund?

Track your federal refund in real time directly from the IRS.

Where’s My Amended Return?

If you filed Form 1040X, use this tool to track the progress of your amended tax return.

IRS Identity Protection PIN

Add an extra layer of security to your tax filings by requesting an IP PIN to prevent identity theft.

Taxpayer Advocate Service Hotline

Independent organization within the IRS that helps taxpayers resolve issues and ensure fair treatment.

For Individual Taxpayers:

💡 Tip: Always have your Social Security Number, EIN, or recent tax return information ready when calling the IRS to verify your identity quickly.

IRS General Tax Help

For questions about filing status, dependents, refunds, or general tax concerns.

📞 1-800-829-1040

🕒 Monday–Friday, 7:00 a.m. – 7:00 p.m. (local time)

Refund Hotline (Automated System)

Check the status of your federal refund anytime using the automated line.

📞 1-800-829-1954

🕒 Available 24 hours a day, 7 days a week.

Taxpayer Advocate Service (For Unresolved Issues)

Get help with delayed refunds, errors, or hardship situations.

📞 1-877-777-4778

🕒 Monday–Friday, 8:00 a.m. – 8:00 p.m. (local time)

For Self-Employed & Small Business Owners:

💡 Tip: Always have your Social Security Number, EIN, or recent tax return information ready when calling the IRS to verify your identity quickly.

Business & Self-Employed Tax Line

For EINs, business deductions, quarterly payments, or other self-employment questions.

📞 1-800-829-4933

🕒 Monday–Friday, 7:00 a.m. – 7:00 p.m. (local time)

Electronic Filing (e-File) Support

For issues with e-file transmissions or rejected returns.

📞 1-866-255-0654

🕒 Monday–Friday, 7:00 a.m. – 7:00 p.m. (local time)

IRS Identity Protection Specialized Unit

For taxpayers who suspect or experienced identity theft.

📞 1-800-908-4490

🕒 Monday–Friday, 7:00 a.m. – 7:00 p.m. (local time)

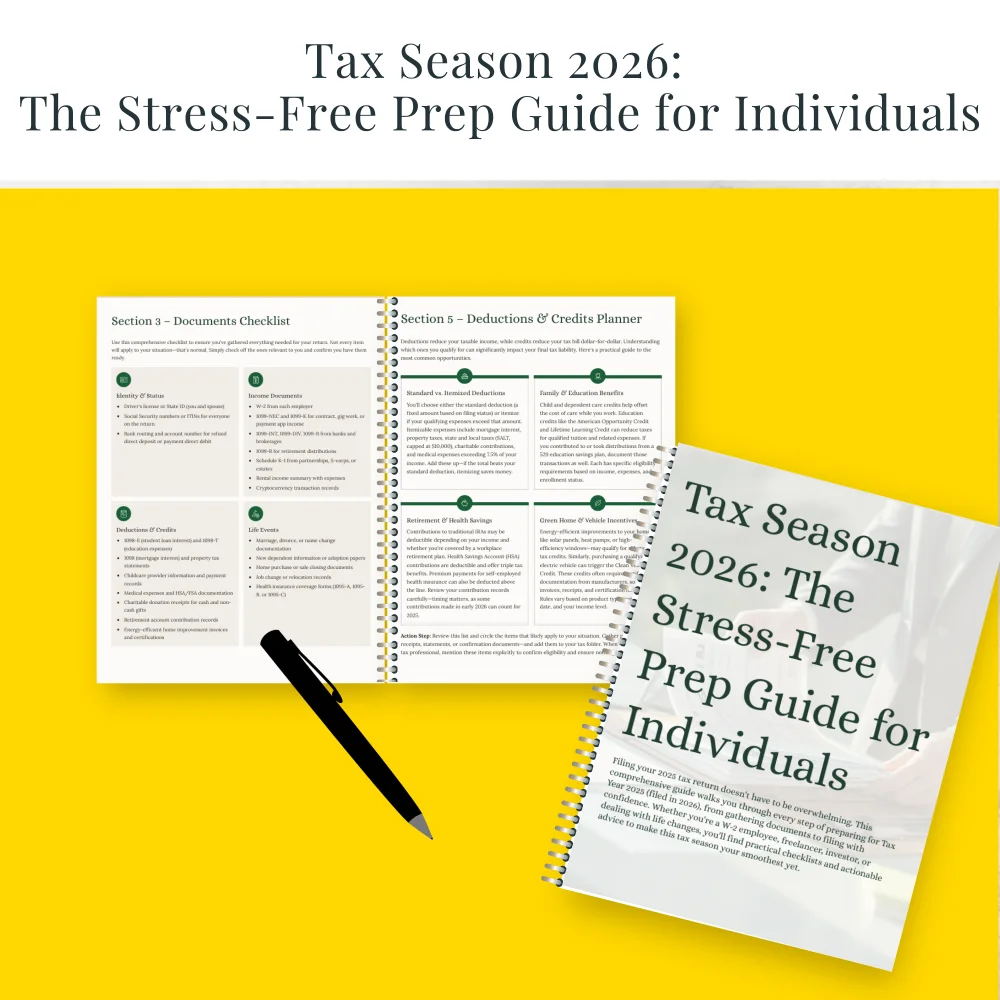

Get Ready for Tax Season...

Grab Your Free 2026 Prep Guide

Stress less, file smarter. This quick, friendly guide shows you exactly what to do and when, so your refund (or payment) is no surprise.

What you’ll get:

A simple month-by-month filing timeline

A complete documents checklist (no more missing forms)

Deductions & credits planner to help you keep more money

Life-events worksheets (new baby, move, marriage, etc.)

Final review checklist + “what to do after you file”

When to DIY vs. hire a pro ...